These are consumer loans that are deferred until the student is out of school. If you need additional funds and have exhausted all other options, you may want to consider a private student loan. Private Student Loans - Available to students from private lenders. This loan would also become part of your loan account that contains your Federal Direct Subsidized/Unsubsidized Loan(s), reducing your number of lenders. To apply, contact the Office of Financial Aid. Loan payments can be deferred and has flexible repayment options. This loan has fixed interest rate, high credit approval rate and streamlined application process.

Citizens and permanent residents. An origination fee of approximately 4% is charged on this loan. Treasury to help pay for their educational expenses.

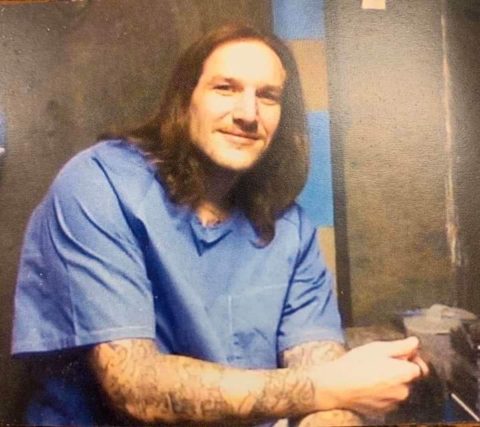

LIFELOCK PROJECT CANVAS LIFE ROUTE PLUS

Annual loan limits and a school's financial aid budget determine the maximum amount of Federal Direct loan offered to a student.įederal Graduate PLUS Loan - The Federal Direct Graduate PLUS Loan is a loan program that enables graduate students to borrow directly from the U.S. An origination fee of approximately 1% is charged on this loan. Unsubsidized Federal Direct Student Loans - A Federal Direct Student loan borrowed from the U.S.

Annual loan limits and a school's financial aid budget determine the maximum amount of Federal Direct loan offered to a student. That is, his or her cost of attendance (COA) must be greater than the Expected Family Contribution (EFC). A student must have financial need to qualify for this loan. Subsidized Federal Direct Student Loans - A need-based Federal Direct Student loan borrowed from the U.S. Funds will credit directly to the student's account with the institutionįederal TEACH Grant - Grant assistance intended for students who agree to teach full-time in high-need subject areas for at least four years in schools that serve students from low-income families. UNK Grant - A need-based UNK grant (money that does not have to be paid back) for undergraduates. Funds will credit directly to the student's account with the institution. UNK Tuition Support - A need-based UNK grant (money that does not have to be paid back) for undergraduates that applies to tuition only. Nebraska Promise Grant - (NSG) A need-based UNK grant (money that does not have to be paid back) for undergraduates who are Nebraska residents. Eligible undergraduate students include those who are Pell Grant eligible, are a Nebraska Resident, and those who generally maintain full-time enrollment. Nebraska Opportunity Grant - (NOG) The State of Nebraska provides funding for this grant (money that does not have to be paid back). The student must be eligible for the Federal Pell Grant prior to receiving an SEOG award. Funds will credit directly to the student's account with the institution.įederal Supplemental Educational Opportunity Grant - (SEOG) Undergraduate grant (money that does not have to be paid back) from the Federal Government based on need. Federal Pell Grant - Undergraduate grant (money that does not have to be paid back) from the Federal Government based on need.

0 kommentar(er)

0 kommentar(er)